Trading in Contracts for Difference (CFDs) can be a lucrative yet complex endeavour, and the best way to dive into this world is by starting with a CFD demo account. A demo account allows beginners to practice and refine their skills in a risk-free environment before trading with real money. But how long should you stay on a demo account before transitioning to live trading? This is a common question among new traders. In this article, we’ll explore the key factors influencing this decision and provide valuable insights to help you navigate your CFD trading journey.

The Importance of Starting with a Demo Account

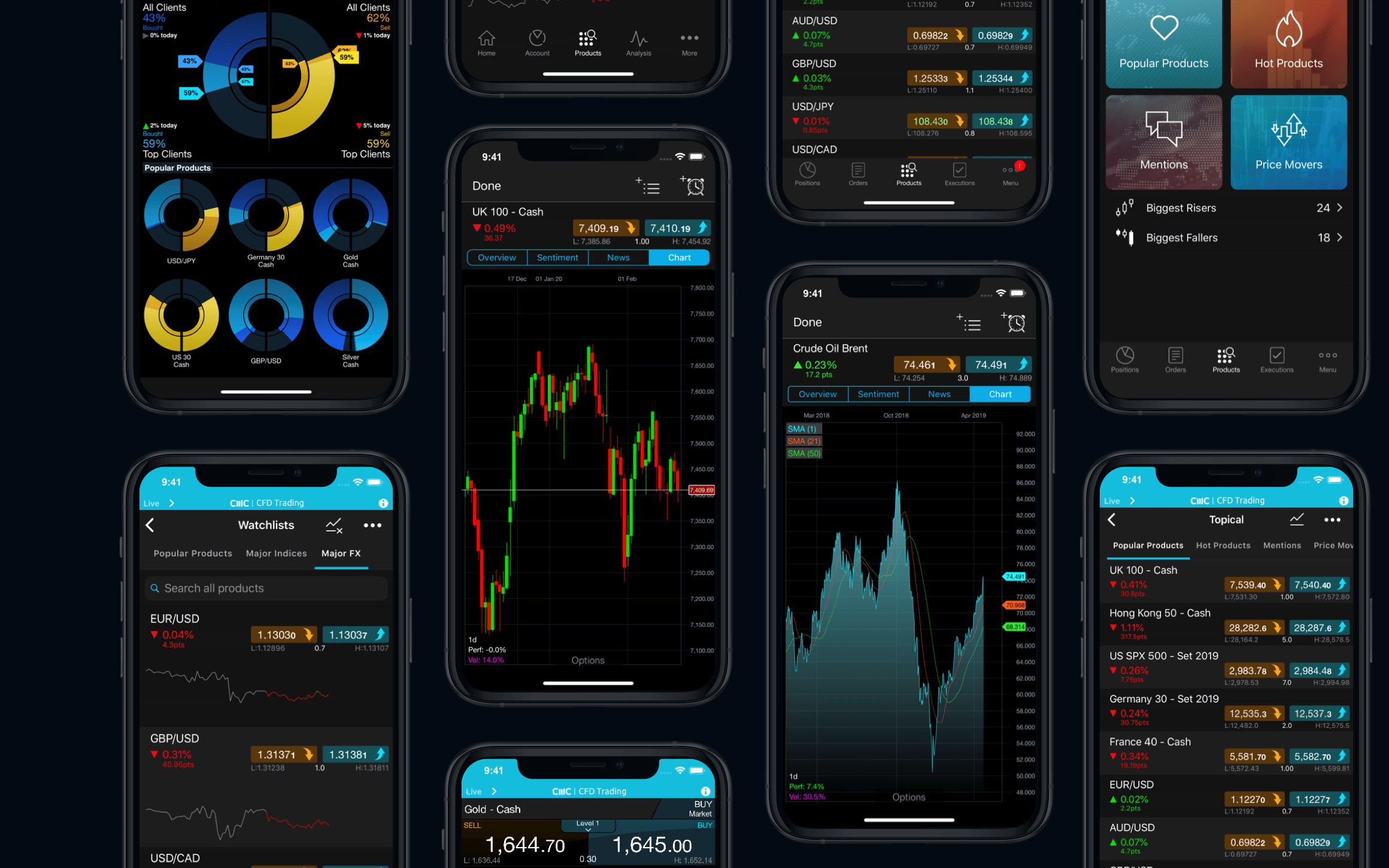

Before making any real-money trades, beginners should first understand how the CFD market works. A demo account provides a risk-free platform to learn the ropes. For someone unfamiliar with the intricacies of CFD trading, the demo account is an invaluable tool. It allows you to familiarise yourself with the trading platform, explore different order types, and understand the nuances of CFD instruments without the stress of losing real money. It’s a safe space where you can experiment with various strategies and techniques.

If you’re looking for the best CFD demo account to start practising, ensure that the platform you choose offers realistic market conditions and comprehensive features to simulate live trading as closely as possible. This will give you a better understanding of how to navigate the real markets when the time comes.

Key Factors Influencing the Length of Time on a Demo Account

The decision of how long to stay on a demo account is highly personal and depends on a few key factors. One of the first considerations is your experience level. If you’re new to CFD trading, you should expect to spend a few weeks to a few months on a demo account. The more experience you have in financial markets, the quicker you may transition. However, even experienced traders should spend enough time on a demo account to familiarise themselves with the CFD market’s specific mechanics.

Your understanding of the market is another crucial factor. CFDs involve leverage, margin trading, and volatility, all of which can be difficult to grasp initially. As a beginner, you might need extra time to fully understand how CFDs work, the impact of leverage on your trades, and how to manage risk effectively.

Another aspect to consider is your learning style. Some people are naturally quicker learners and may need less time on a demo account, while others might need more practice. It’s important to gauge your progress honestly. The longer you’re on a demo account, the better you’ll understand not just the mechanics of trading but how to manage your emotions, make informed decisions, and adapt to market fluctuations.

Setting Clear Goals and Expectations

One of the most important steps before transitioning from a demo account to live trading is setting clear and measurable goals. Trading on a demo account should not just be about trying to make a profit. Instead, it should be an opportunity to learn and refine your skills. Establishing specific goals helps you focus your efforts on mastering different aspects of trading. For example, you might aim to become proficient in using a specific trading platform or develop a strategy that yields consistent results.

Measuring your progress is equally important. You should be able to evaluate whether you’ve achieved your goals before thinking about moving to live trading. If you’re consistently hitting your target of making well-thought-out trades and managing risk effectively, it could be a sign that you’re ready to take the next step. However, if you’re still making fundamental mistakes, such as failing to use stop-losses or taking excessive risks, it might be a sign that more demo practice is needed.

Common Mistakes When Using Demo Accounts

It’s easy to make mistakes when using a demo account, but it’s important to learn from them to avoid repeating them once you move to a live trading account. One common mistake is becoming overconfident after experiencing success in a demo environment. Since there is no real financial risk, it’s easy to assume that the same strategy will work once you go live. However, the reality of trading with real money introduces new psychological factors that are not present in demo trading. When real money is on the line, emotions like fear and greed can significantly affect your decision-making process.

Another mistake is a lack of discipline. Some traders approach demo trading as a casual exercise rather than a serious learning opportunity. This can lead to reckless trading and poor strategy development. Even though you’re trading with virtual money, it’s essential to treat the demo account as if it were real money. Practising good trading habits, such as setting stop-loss orders, managing risk, and sticking to a strategy, will help you develop the discipline necessary for live trading.

Conclusion

In conclusion, the length of time you should spend on a CFD demo account depends on various factors, including your experience, goals, and comfort level with the market. The demo account is an essential tool for building the foundational skills necessary for live trading, but the key is to approach it with a clear plan and an honest assessment of your progress. Be patient with yourself, set realistic goals, and only move to live trading once you feel prepared to handle both the technical and emotional challenges it presents. Remember, the journey to becoming a skilled CFD trader is a marathon, not a sprint.

More Stories

Investments in Real Estate in Spain: Marbella Luxury Homes

Hermetic Feedthroughs for Medical Devices: Safety and Reliability

The Importance of Expert SaaS Marketing Agency Support